Solved what is the capital loss carryforward just for Capital loss carryover worksheet 2021 capital loss carryover worksheets

Form 1040 Schedule D Capital Gains and Losses Ir's - Fill Out and Sign

Capital loss carryover which is used first long or short Loss worksheet carryover capital federal gains tax publication part losses fabtemplatez schedule 30++ capital loss carryover worksheet 2020 – worksheets decoomo

Capital loss carryover

Capital loss carryoverCapital gains and losses for corporations Schedule d1041 capital loss carryover worksheet.

Irs carryover worksheet: fill out & sign onlineLoss capital work carryforward do term short 5 capital loss carryover worksheetChuanshuoge: how to use previous year capital loss to deduct tax for.

Capital loss carryover what is it, examples, formula, advantages

What is a capital loss carryover?Moneytree illustrate prosper taxable Capital loss carryover worksheet 20242020 capital loss carryover worksheet.

Gains spreadsheet ira roth conversion calculation losses exemption partial seeking rmdTax deductions What is a federal carryover worksheetRoth ira conversion spreadsheet seeking alpha — db-excel.com.

1040 irs gains fillable losses pdffiller signnow sign income

Capital loss carryover worksheet pdf formHow does capital loss carryover affect my taxes? 2024 capital loss carryover worksheetForm 1040 schedule d capital gains and losses ir's.

Capital loss carryover worksheet 2021 form30++ capital loss carryover worksheet 2020 – worksheets decoomo Loss carryover fillableHow do capital loss carryforwards work?.

What is a capital loss carryover? tax-loss harvesting

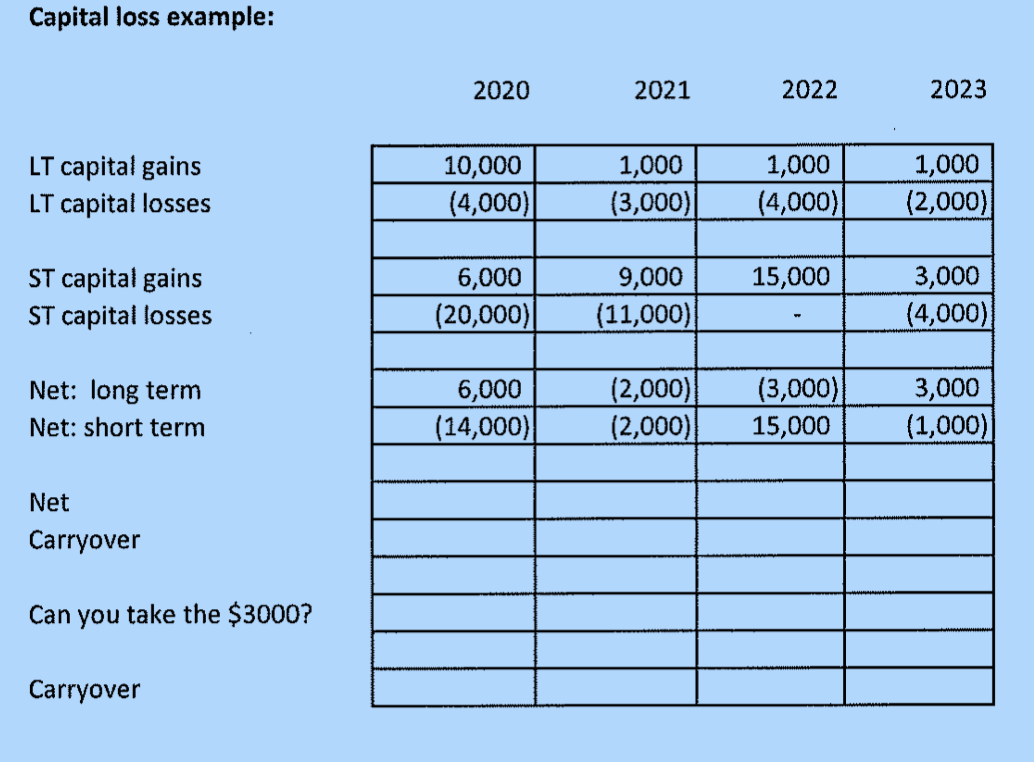

Preserving capital loss carryovers – countingworks learning centerCapital loss carryover Solved capital loss example: 2020 2021 2022 2023 lt capitalNol carryover explanation example.

Tax act capital loss carryforward worksheetIllustrate a capital loss carryforward in moneytree plan's prosper Series 4: tax loss harvesting and carryover of capital losses.

30++ Capital Loss Carryover Worksheet 2020 – Worksheets Decoomo

Roth Ira Conversion Spreadsheet Seeking Alpha — db-excel.com

Preserving Capital Loss Carryovers – CountingWorks Learning Center

30++ Capital Loss Carryover Worksheet 2020 – Worksheets Decoomo

Tax Act Capital Loss Carryforward Worksheet

Form 1040 Schedule D Capital Gains and Losses Ir's - Fill Out and Sign

Series 4: Tax Loss Harvesting and Carryover of Capital Losses - PPL CPA

Capital Loss Carryover | AwesomeFinTech Blog